SINGAPORE, 22 December 2021 – A new report by the World Wide Fund For Nature Singapore (WWF-Singapore), and the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP), documents the way Development Finance Institutions (DFIs) in the Asia Pacific, predominantly involved in infrastructure investment, are integrating climate- and biodiversity-related risks and opportunities, into their purpose setting, policies, processes, people management, product development and portfolio management.

The report finds that, awareness of climate change is growing, but still needs to be better embedded into most DFIs’ strategies. Biodiversity loss has not yet attained the same level of awareness. More progress and support is required to translate this into organisational design and management so that DFIs can facilitate national climate and biodiversity goals. (See Annex A for more results)

“The world is increasingly facing intertwined challenges which are setting a new context for sustainable development, particularly in emerging economies. Infrastructure plays a critical role in society because it can influence development far into the future — both positively and negatively. For infrastructure to serve a positive purpose, risks to people and the planet over its life cycle must be managed. This is important due to the scale of new infrastructure investment that is expected in the coming decades.” says Anders Nordheim, Senior Vice President, Asia Sustainable Finance, WWF-Singapore

In the Asia Pacific, DFIs have a unique opportunity and responsibility to shape the way infrastructure is delivered. Given their public mandates, authority, and supervision, combined with their significant scale in terms of assets and financing, they are perfectly placed to actively contribute to the Paris Agreement and the post-2020 Global Biodiversity Framework. They can play a catalytic role both in setting ambitious targets towards climate neutral- and biodiversity-positive infrastructure and supporting the implementation of agreed actions.

Beyond mobilizing resources by unlocking public finance and leveraging private finance, DFIs can strongly influence all sectors of society, including governments, clients, and private capital, to further mainstream climate and biodiversity in all relevant public and private decision-making. DFIs should strive to do more good and commit to net-zero emissions, become nature positive, and deliver on these commitments.

— ENDS —

About WWF-Singapore

World Wide Fund for Nature (WWF) Singapore is one of the world’s most respected independent conservation organisations. WWF’s mission is to stop the degradation of the earth’s natural environment and to build a future in which humans live in harmony with nature. As one of WWF’s international hubs, WWF-Singapore supports a global network spanning over 100 countries. About WWF-Singapore

World Wide Fund for Nature (WWF) Singapore is one of the world’s most respected independent conservation organisations. WWF’s mission is to stop the degradation of the earth’s natural environment and to build a future in which humans live in harmony with nature. As one of WWF’s international hubs, WWF-Singapore supports a global network spanning over 100 countries. We work to meet key conservation goals, such as deforestation, haze pollution, food security, sustainable finance, sustainable consumption and illegal wildlife trade. For more information, visit wwf.sg.

Annex A

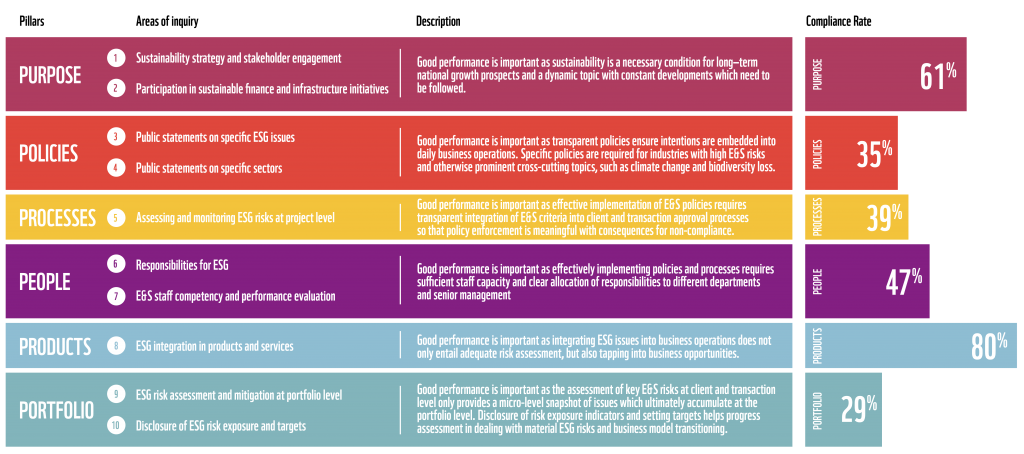

- Few DFIs have sector-specific environmental and social (E&S) requirements, policies, or up-to-date exclusionary criteria aligned with international best practices on issues such as financing fossil fuels. This limits their ability to manage E&S risks. DFIs need to take a strategic approach to align sector and safeguard policies with the Paris Agreement and the post-2020 Global Biodiversity Framework.

- Most DFIs lack adequate use of ESG (environmental, social and governance) metrics, evaluation and screening tools including use of sustainable infrastructure specific standards and biodiversity-related impact evaluation methods and datasets. This restricts their ability to implement safeguards and ‘do no harm’.

- Many DFIs have senior management and/or board oversight of ESG issues, a dedicated sustainability team and provide some training to staff on ESG-related issues, however, there is room for improvement on issues such as specialised training and linking ‘pay’ to sustainability performance.

- DFIs are developing green financial products and specialised funds to finance sustainable infrastructure, but these need to be scaled up and diversified across sectors and geographies.

- Disclosure and target-setting for carbon-related assets or biodiversity-related dependencies remain low. DFIs need support to strengthen risk assessment and reporting of climate– and biodiversity-related financial risks and to improve tracking methodologies to include the non-Paris aligned share of portfolios.

- While ‘doing no harm’ and negative ESG screening is the first step, the ultimate aim must be to progress towards sustainability-themed business lines which facilitate the achievement of national climate and biodiversity commitments. This would benefit from clarification of mandates and expectations to work with external stakeholders and adopting an adequate framework for delivering sustainable infrastructure.