About

SPRING is an interactive toolkit that enables assessment and benchmarking of critical Environmental & Social integration performance for asset managers across the globe

OBJECTIVES OF SPRING

| Integrate | Invest | Implement |

|---|---|---|

| Embed sustainability into private banks’ purpose and policies. | Develop risk management processes and capacity to ingrain sustainability into organisational culture, governance, and incentives. | Sustainability practices through active engagement, sustainability screening, and understanding clients’ sustainability preferences. |

| Making sustainability an integral part of private banks’ policies and processes | Investing in human capital and good governance structures, including employee upskilling and performance based incentives. | Leverage active engagement and proxy voting to drive real-world decarbonization |

| Developing private banking and wealth management-specific sustainability policies | Incorporate climate and nature-related financial risks into risk assessments, stress testing, and scenario analysis | Develop a client onboarding policy that includes a sustainability questionnaire and an ESG due diligence process |

| Aligning short and long-term plans to integrate climate and nature-related factors into financial and investment decision-making processes. | Develop sustainable finance products to offer clients a wide variety of products | Engage and collaborate with multiple stakeholders to understand their sustainability expectations and needs. |

METHODOLOGY: ENVIRONMENTAL & SOCIAL

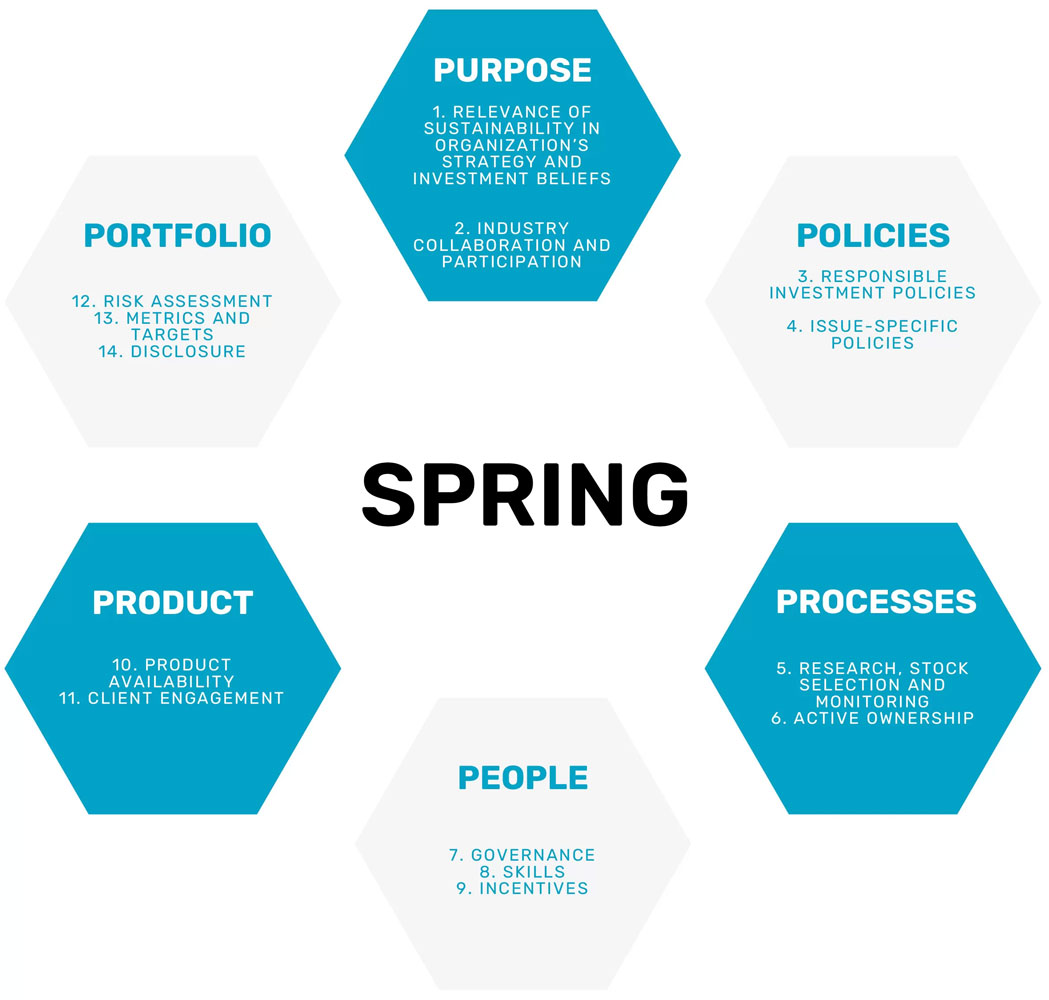

We have developed the SPRING framework to provide private banks with a comprehensive approach to integrating environmental, social, and governance (ESG) factors into their business practices. The framework offers guidance on key areas, such as risk management, governance structures, client due diligence, and executive compensation. By adopting the SPRING framework, private banks can foster a strong sustainability culture and drive concrete changes in the economy. Here’s an overview of the key components of our SPRING framework:

| Pillar | Description |

| Purpose | This pillar looks at how objectives and commitments, such as the 1.5 degree target, alignment to the SDGs, and sustainability-related collaborative initiatives such as PRI, PRB, TCFD, TNFD, etc., are integrated into the bank’s strategy and vision. This alignment can be achieved at both the group level, and the private bank level. |

| Policies | This pillar assesses the bank’s maturity with respect to responsible investment policies and the streamlining of sustainable investing activities. These policies should help ensure that key environmental and social issues are incorporated into decision-making processes. Having transparent policy commitments and public disclosures demonstrates the bank’s openness and accountability to its stakeholders. |

| Processes | Processes help connect the bank’s mission and policies to its business operations. This pillar examines whether ESG factors are integrated into the entire business process, from research and investment to due diligence and audits. In addition, it determines whether the bank uses tools such as active engagement with portfolio companies and voting rights on behalf of clients in order to generate long-term shareholder value and meet decarbonisation and impact commitments. |

| People | Sustainable investing requires leadership that prioritises sustainability and clear roles and responsibilities for sustainability. Training staff in ESG issues is essential for effective integration of ESG factors. Banks can foster a culture of sustainability by aligning employee incentives with the organisation’s sustainability objectives. |

| Products | Serving as advisors to their clients, private banks have the responsibility of capitalising the rising interest in responsible investment. They can achieve this by providing sustainable financial products and incorporating ESG factors in their clients’ philanthropic endeavours. This approach enables private banks to fulfil their essential duty of safeguarding the wealth of their clients. |

| Portfolio | Proper evaluation of ESG risks and opportunities at the portfolio level is crucial for effective risk management. Regular portfolio-level risk assessments and use of appropriate metrics and targets can provide a comprehensive view of ESG risk. Portfolio-level disclosure and external assurance on ESG-related disclosures are also essential. |

Seven private banks with a presence in Singapore volunteered to participate in the pilot study during the period of October 2022–February 2023. The participating private banks have headquarters in the US (1), Europe (2), and Asia (4).

We have collected responses from the participating private banks through an online questionnaire, which comprises questions from the SPRING framework sub-indicators. Thereafter, the respondents were engaged by WWF-Singapore’s Sustainable Finance team through calls and email exchanges to discuss, review, and understand the private banks’ responses.

The responses are collated and analysed by WWF-Singapore’s Sustainable Finance teams, and the results are presented anonymously.

The objectives of the pilot are:

|  Foster deeper working relationships with private banks. Foster deeper working relationships with private banks. |  To identify and support private banks in areas such as capacity building, training, and enhancing ESG integration To identify and support private banks in areas such as capacity building, training, and enhancing ESG integration |

Through our study, we recognise that DPM may currently represent only a small portion of the private bank’s business. However, for this first version of the SPRING framework, we have considered a private bank’s own DPM products and third-party asset managers’ products. WWF-Singapore assesses global asset managers under our RESPOND framework.

ABOUT WWF

WWF has worked with the financial sector (banks, investors and regulators) for more than a decade, with the objective of accelerating the integration of ESG risks and opportunities into mainstream finance, so as to redirect financial flows to support the Paris Agreement and the SDGs. Our approach to sustainable finance leverages:

Our conservation experience on the ground across WWF’s global practices.

Our partnerships with companies on key issues such as climate, energy, food and water to drive sustainability.

Our participation in cutting-edge sustainable finance initiatives (e.g. Science Based Targets initiative and the European Commission’s Technical Expert Group on Sustainable Finance).

This has allowed us to strengthen lending and investment criteria for key industry sectors, provide insights and data on environmental and social risks, fulfil critical research gaps, help unlock innovations in sustainable finance products and convene key stakeholders to progress the sustainable finance agenda.

To assess the ESG integration maturity levels across the above-mentioned six pillars within the private banks

To assess the ESG integration maturity levels across the above-mentioned six pillars within the private banks